by Vince Kuraitis and Neil P. Jennings of Untangle Health

Here’s an outline of today’s blog post:

- A Brief Recap: What are UDHPs?

- Thesis: EHRs Can Expand to Become UDHPs

- EHRs Currently Own the Customer Relationship

- Many Customers Have an “EHR-First” Preference for New Applications

- Epic and Oracle Health are Making Strong Movements Toward Becoming UDHPs

- Antithesis: EHRs Can NOT Become Effective EHRs

- EHRs Carry a Lot of Baggage

- Customers are Skeptical

- EHR Analytics Are NOT Optimized To Achieve Critical Health System Objectives

- EHR Switching Costs are Diminishing

- Cloud Native Platforms Accelerate Innovation and Performance

- It’s Not in EHR DNA to Become A Broad-Based Platform

- Synthesis and Conclusion

This is a long post…over 4,000 words…so we’ve clearly got a lot to say on the matter. Hope you brought snacks!

A Brief Recap: What are UDHPs? (Unified Digital Health Platforms)

In our previous extensive post on UDHPs, we described them as a new category of enterprise software. A December 2022 Gartner Market Guide report characterized the long-term potential:

The [U]DHP shift will emerge as the most cost-effective and technically efficient way to scale new digital capabilities within and across health ecosystems and will, over time, replace the dominant era of the monolithic electronic health record (EHR).

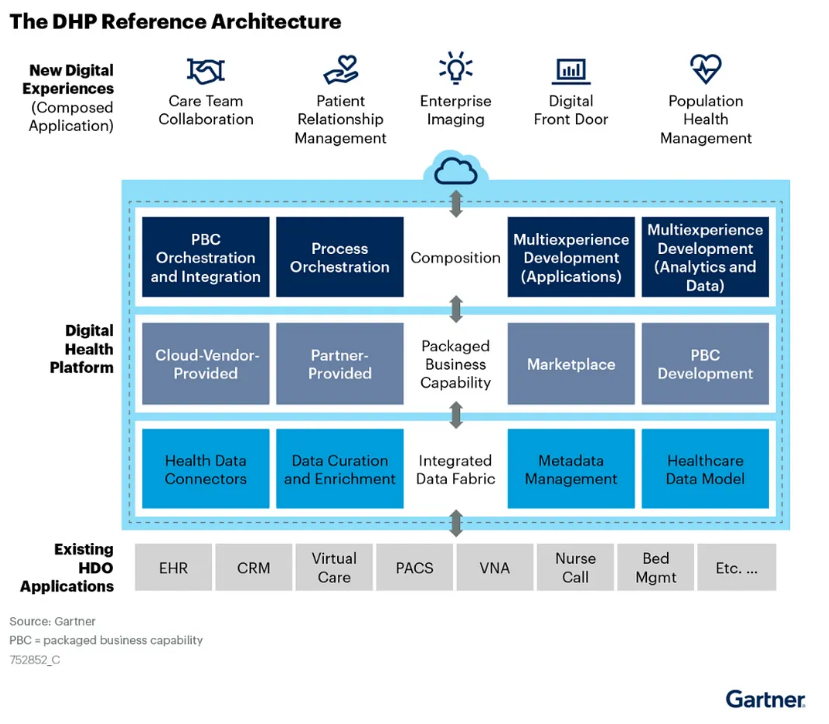

The DHP Reference Architecture is illustrated in a blog post by Better. Note that UDHPs are visually depicted as “sitting on top” of EHRs and other siloed sources of health data:

We noted that almost any type of large healthcare organization — health systems, health plans, pharma companies, medical device companies, etc. — had a need for UDHPs. However, today’s focus is more narrow — we limit the discussion to UDHPs in hospitals and health systems, primarily in the U.S. We use the term “health system” to encompass hospitals and regional health delivery systems.

In this post, we focus on the two largest EHR vendors in the U.S. — Epic and Oracle Health; they have a combined market share of 65% of hospitals and 77% of hospital beds.

In the remaining sections, we will lay out arguments on both sides of the issue of whether EHRs can (or cannot) expand to become UDHPs. The graphic below is our crack at a visual summary. The balloons represent the thesis – that EHRs can expand to become UDHPs; the anchors represent the antithesis – that EHRs can not expand to become UDHPs.

Thesis: EHRs Can Expand To Becoming UDHPs

Let’s look at the case for EHRs expanding to become effective UDHPs.

1) EHRs Currently Own the Customer Relationship

Fueled by federal HITECH incentives and mandates, health systems have made significant investments in their existing EHRs:

- As of 2021, 96% of non-federal acute care hospitals in the U.S. had adopted a certified EHR.

- They made huge capital commitments to purchase and install their EHR, often hundreds of millions of dollars.

- Many existing clinical workflows are built on EHRs.

- A majority of a patient’s clinical data in a health system resides inside their EHR.

According to SoftwareReviews, Epic and (Oracle) Cerner Millennium EHRs receive good to high ratings from health system customers.

Thus, any new vendor attempting to sell new healthcare enterprise software (i.e., a UDHP) will face a high hurdle: “We already have an EHR…why should we consider you?”

2) Many Customers Have an “EHR-First” Preference for New Applications

Health systems have been trying to stay afloat in a veritable tsunami of point solutions. This creates a range of challenges, including:

- Complexity and integration challenges

- Regulatory and compliance risks

- Fragmentation of care

- User adoption and training

- Cost and ROI concerns

As shown in the graphic below, a 2024 Bain & Company/KLAS survey of health systems found that 81% increasingly plan to look to existing vendors before considering offerings from new vendors.

More specifically, the survey found that 79% plan to look to their EHR vendor first for new solutions before looking to others.

University Hospitals is an example of a health system with an EHR-First strategy. According to Robert Eardley, CIO, this guiding principle ensures the health system prioritizes tools and innovations available within its Epic electronic health record platform whenever feasible.

3) Epic and Oracle Are Making Strong Movements Toward Becoming UDHPs

Perhaps the best argument that EHRs are capable of becoming Unified Digital Health Platforms is that Epic and Oracle Health are already making bold moves. Let’s take a look at them individually.

Epic’s EHR Expansion Plans

Epic is more than a basic EHR — it offers existing customers a broad base of capabilities. Interop guru Brendan Keeler has written extensively about Epic. In his article “An Epic Saga: The Origin Story” he describes how Epic grew to its current size. The Appendix provides an extensive list of “Epic Modules.”

In an insightful 2024 analysis of Epic’s dominant market position, Seth Joseph included a list of Products You Can Replace with Epic. The list included over 150 capabilities “to help you identify areas where you could use your Epic software to either replace or avoid purchasing niche applications…”

Epic also is expanding new offerings to new customer categories. In the article “Epic Beyond the Provider Empire“, Brendan Keeler provides a detailed list:

Health Grid — software sold to

- Labs

- Medical device companies

- Payers

- Telehealth companies

- Clinical trials

Health Grid Adjacent offerings

- Cosmos — “a massive clinical dataset created by pooling information from Epic health systems”

- Payer Gateway — a “lighter-weight service for payers that enables them to receive clinical data from Epic healthcare organizations”

- Chart Gateway — “Epic’s service that streamlines how life insurance companies get medical records from Epic healthcare organizations”

- EpicCare Link — “a web-based portal product that lets Epic healthcare organizations offer non-Epic providers a way to interact with them.”

Other stuff

- Supply Shop — services offerings

- Revcyclers — “Third parties working with Epic and provide billing services to help improve revenue cycle outcomes”

- Cornerstone Partners — deep relationships with Microsoft and InterSystems

But wait…there’s more. At HIMSS 2025, Epic announced additional AI capabilities in the works and that it is developing a healthcare-specific enterprise resource planning (ERP) system. While we view an ERP as a big stretch, it’s also a potential game-changer for Epic.

Using a framework created by David Yuan of Tidemark, Brendan Keeler capsulized Epic’s broader platform strategy:

With additions like the ERP, Epic is clearly evolving beyond a traditional EHR system, but is it enough to meet the UDHP needs of modern health systems?

Oracle Health Goes Beyond Being a Traditional EHR

In October 2024, Oracle announced a new EHR. As described by the company, Oracle Health has many characteristics that make it look more like a UDHP than a traditional EHR. It aims to go significantly beyond the capabilities of a traditional EHR:

- Embedded Artificial Intelligence (AI): Unlike EHRs where AI is often a bolt-on, Oracle’s new system is designed with AI as a core component, integrated across the entire clinical workflow. This includes a Clinical AI Agent, AI-driven insights at the point of care, AI-powered summaries, and personalized care plans.

- Enhanced User Experience: Recognizing the clinician burden associated with traditional EHRs, the new system emphasizes an intuitive and user-friendly design with features like voice-driven navigation and search, multimodal search, and a customizable interface.

- Oracle Health Data Intelligence is an AI and analytics solution embedded within the EHR, enabling integration of disparate data sources, real-time insights, and population health management tools.

- Next-Generation Oracle Cloud Infrastructure offers advantages of enhanced security, scalability, and performance, and better data exchange.

- Patient Engagement Tools: The new EHR includes a reimagined patient portal focused on empowering patients to access and control their medical history, facilitating communication with providers, and enabling self-service capabilities for patients to manage appointments, pay bills, and access health information.

- Focus on Value-Based Care: The system is designed to support value-based care models by streamlining information exchange between payers and providers, improving care coordination, and providing insights into cost and resource allocation.

Oracle Health aims to move beyond being a system of record to becoming a system of action — an intelligent, integrated platform that actively assists clinicians, engages patients, and drives better outcomes in a more efficient and secure manner. Oracle’s most recent announcement of a platform partnership with Cleveland Clinic and G42 is consistent with the migration toward becoming a UDHP.

Oracle Health is still in its early stages of a roll-out, with an early adopter program launched in 2025. Therefore, extensive, widely published surveys and large-scale customer feedback about this new platform aren’t yet available.

Antithesis: EHRs Can NOT Become Effective UDHPs

Now let’s examine arguments suggesting that EHRs aren’t capable of becoming health systems’ “platform of platforms” — a UDHP.

1) EHRs Carry a Lot of Baggage

Today’s EHRs are criticized on a number of fronts: errors and safety issues, cost, lack of competition, lack of interoperability, and lack of usability for clinicians. COVID-19 highlighted many of the weaknesses in EHRs as being “large, slow monoliths that don’t quickly adapt to new, emergent demands on their design and workflow.”

But what about the high satisfaction scores previously cited? EHRs are more likely to consider health system administrators as their “customers.” As noted above, clinician “user” satisfaction is generally low.

Vendors also have allowed customers to customize EHR implementations. Local customization leads to substantial differences in how the system operates from one site to another. The often-used colloquial phrase is that there are “50 dialects of Epic.” While some degree of EHR customization is necessary and can increase clinician buy-in, over-customization can result in difficulty interoperating, as data definitions and workflows can differ greatly. With each EHR instance potentially unique, extending EHRs to become UDHPs carries forward organization-specific configurations which may result in substantial longitudinal maintenance (for either the health system or the partners connected to the EHR).

Finally, Epic’s unique size and dominant market position could attract antitrust challenges from government regulators. Even today, as Seth Joseph documents, Epic is already attracting lawsuits from multiple “smaller, adjacent vendors.” As Epic adds ERP and Cerner and Epic continue adding adjacent features and capabilities, they are expanding their positions, potentially garnering additional regulatory oversight.

2) Customers are Skeptical

Even while many health systems might have an “EHR-First” integration preference, many are also skeptical of their EHR vendor’s promises and their ability to integrate new apps. Sage Growth Partners report entitled The New Healthcare C-Suite Agenda: 2024-25 addressed the issue:

C-Suites are at a technology crossroads: Very few are satisfied with their EMR vendor, the market is flooded with point solutions but integrations are frustrating employees more, and despite the policy relaxations around telehealth during the last three years, telehealth and in-home hospital tools are not well integrated with EMRs.

When asked “How well does your current vendor live up to the promises it makes about the EMR, only 26% responded “extremely well” or “very well.”

Perhaps most importantly, “𝐨𝐧𝐥𝐲 𝟏𝟕% 𝐨𝐟 𝟐𝟎𝟐𝟑 𝐫𝐞𝐬𝐩𝐨𝐧𝐝𝐞𝐧𝐭𝐬 “𝐬𝐭𝐫𝐨𝐧𝐠𝐥𝐲 𝐚𝐠𝐫𝐞𝐞” 𝐭𝐡𝐚𝐭 𝐭𝐡𝐞 𝐄𝐌𝐑 𝐰𝐢𝐥𝐥 𝐦𝐞𝐞𝐭 𝐭𝐡𝐞 𝐦𝐚𝐣𝐨𝐫𝐢𝐭𝐲 𝐨𝐟 𝐭𝐡𝐞𝐢𝐫 𝐨𝐫𝐠𝐚𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧’𝐬 𝐧𝐞𝐞𝐝𝐬 𝐦𝐨𝐯𝐢𝐧𝐠 𝐟𝐨𝐫𝐰𝐚𝐫𝐝, down from 25% in 2022.”

3) EHR Analytics Are NOT Optimized To Achieve Critical Health System Objectives

Any individual EHR can NOT be viewed as the “source of truth” for a patient’s clinical history:

Multiple EHR Vendors. Both in the U.S. and abroad, larger health systems often are Frankenstein’s monsters stitched together from various acquisitions. Thus, they frequently sport a patchwork of competing EHRs. A HIMSS Analytics study found that the average health system has 18 different EHR vendors across inpatient and outpatient settings.

Multiple Point Solutions and Sources of Data. Patient data in health systems is spread across multiple systems, not just EHRs.

Patient and Data “Leakage.” Today’s patients are more motivated by convenience than loyalty to one health system; patient leakage across care providers is significant. A study in International Journal of Medical Informatics found that “only 4.5 % of expenditure-weighted individual Medicare beneficiaries had their MU medical records associated with a single vendor, while 19.8 % of expenditure-weighted beneficiaries had their MU medical records stored in 8 or more vendors.”

Patient Health and Care Data is Increasingly Outside of EHRs. A McKinsey study examined how a lifetime of patient health and care data is likely to be created (see the graphic below).

By adding the numbers in the right column, you’ll see that a person generates an estimated total of 1,106.4 terabytes of health data over the course of a lifetime. However, only 0.4 terabytes — or 0.04% — is clinical data, i.e., likely to reside in today’s EHRs.

The implication: EHRs are likely to contain only a fraction of a patient’s health and care data. Optimal end-to-end analytical systems for patient data — ones designed for both prevention and care – will need to pull data from across a diverse range of sources. These capabilities don’t exist in today’s EHRs.

We’ve noted that the roots of EHRs are as systems of record to document processes for fee-for-service billing, but it goes deeper than that.

Driven by early incentives like Meaningful Use, EHR design heavily prioritized billing for individual services and administrative tasks. Consequently, their architecture emphasized documenting the volume of care delivered for reimbursement, rather than the value of patient outcomes and efficiency.

The limited interoperability inherent in many early EHR systems fostered data silos. This fragmentation made it difficult to achieve the comprehensive, holistic patient view essential for effective value-based care (VBC) and value-based payments (VBP), care coordination, population health management, total cost of care measurement and management, and other capabilities needed for cutting-edge health systems.

In turn, traditional EHRs typically lacked access to longitudinal claims data and the sophisticated analytics necessary to robustly measure costs and patient outcomes. They also frequently lacked standardized mechanisms for capturing patient-reported outcomes (PROs) and didn’t streamline clinical workflows to specifically support value-focused care delivery. As a result, these systems weren’t inherently designed to optimize for the principles and diverse payment models of VBC.

While EHR technology has advanced, these foundational limitations continue to present significant hurdles for health systems navigating the complex transition towards VBC and population health. Addressing these inherent design constraints is crucial for realizing the full potential of digital health in a future-proofed, value-driven healthcare landscape.

4) EHR Switching Costs are Diminishing

In the past, switching EHRs was akin to moving houses during a blizzard…with three toddlers and a herd of goats. High switching costs created a defensive moat to protect EHRs from competitors, either other EHRs or a new category of UDHPs.

However, government policy, legislation, and regulation over the past two decades have promoted interoperability and appropriate exchange of patient data. The HITECH Act, the 21st Century Cures Act, the promotion of HL7 FHIR APIs, and the creation of TEFCA exemplify this trend.

As patient data becomes more fluid and readily shareable across different systems, switching costs are diminished. This is even more pronounced outside the U.S., where standards like openEHR – a standardized clinical data model which separates data from applications – are gaining traction, demonstrating the potential of data standardization to ease system transitions. The EU Data Act mandates the ability to switch data providers seamlessly.

Furthermore, the evolution towards a UDHP doesn’t necessarily require a complete and immediate EHR replacement. As we discussed in a previous blog post, UDHPs can be architected to integrate with and leverage existing data repositories, including EHRs. This incremental approach to UDHP adoption can significantly reduce the perceived and actual costs of transitioning to a more unified digital health ecosystem.

5) Cloud Native Platforms Accelerate Innovation and Performance

The roots of EHRs are as systems of record to document fee-for-service billing processes, replacing on-site processes with (typically) on-prem software. UDHPs, on the other hand, are typically cloud native software, allowing broad scalability, availability, and acting as hubs for innovation. With CHIME’s 2024 survey suggesting “24% of CIOs highlighted applicational rationalization and optimization a top priority,” this begs the question: where should this application rationalization and optimization take place?

Cloud native software is a strong contender, offering many of the CIO-sought benefits and the ability to scale in a cost-transparent way. Neil’s recent piece “Head in the Cloud: Today’s Healthcare Executive” covers the shift to cloud-first infrastructure as a result of more than just market needs, but also a change in leadership. As the Epic-selecting CIOs of the 2010s are retiring, a new technologist profile is emerging and leaning cloud-first.

To be clear, we are not referring to simply lifting-and-shifting an EHR from on-prem to the cloud. While changing hosting providers and locations can add incremental benefits to performance, cost of ownership, and scalability, the full benefits of cloud-first platforms are not achieved by migrating legacy software.

To get the full benefits of a cloud-first approach, there will need to be a re-architecture of systems. This is a large task, but we have many of the pieces today, with scalable databases, Master-Data-Management products, EMPI products, and headless EHRs (ONC Certified EHRs of record that permit customers to reskin the patient and provider-facing experiences). Some leading organizations are already creating cloud-hosted centralized data platforms that create a single source of truth, brokering data across their technical ecosystem. Below, we’ll cover some leading benefits of this more encompassing cloud-first approach.

Where EHR vendors have historically moved slowly, cloud service providers are rapidly adding shared services and tooling. With their consumption-based pricing models, they are directly incentivized to enable and encourage onboarding new users, use cases, applications, and databases. Not everyone will need or want to build from scratch in the cloud, and as highlighted in the previous post, cloud-hosted ERP platforms are also rising to the occasion to meet UDHP needs.

Beyond the list of benefits above, it is the approach of these new service providers that encourages us to question whether EHRs can remain UDHPs in the long term. The cloud service providers (or hyperscalers) and ERPs are willing to integrate with anyone, host and provision anything anywhere, and provide centralized, distributed accessible, – and also open – systems. AWS and Azure, for example, would happily host your Epic instance, connect to your athenaHealth tablespace, and your point solutions. Please, continue adding more!

And, they have the most advanced, scalable databases and data platforms to accommodate that data. This makes the next generation of point solutions, CDS features, or AI-derived agents even easier to create as cloud-first, as the data are already there, centralized, and accessible.

EHR customers are also flocking to cloud vendors already, seeing benefits in hosting costs, scalability, testing, and other areas. From KLAS’ Epic in the Public Cloud 2024 report: “The majority [of survey respondents] utilize a cloud provider for Epic disaster recovery, and this often serves as the initial step in the Epic cloud migration journey.” IDC takes it a step further in their 2024-2025 Health Data Platforms for Providers Vendor Assessment, introducing multi-cloud implementations as a possible route, stating that “Nearly half (49.2%) of U.S. healthcare providers will prioritize IT modernization initiatives extending into 2025. This emphasizes the need for platforms that scale effectively and integrate seamlessly with existing and emerging systems in the healthcare ecosystem. Multicloud adaptability will be essential to achieving this.“

This suggests one answer to the question of where application rationalization and optimization should occur: in the cloud. The cloud vendors are willing and able to accommodate any EHR and are aligning incentives to accelerate cloud adoption. If these cloud platforms can manage healthcare’s data complexity, what’s stopping them from being the UDHPs accelerating innovation in healthcare?

6) It’s Not in EHR DNA to Become a Broad-Based Platform

EHRs are set in their ways – kinda like your uncle who still uses a flip phone. Unlike many of today’s most successful tech companies, EHRs are not “platform native.” We list some potential ways this could inhibit an EHR’s expansion toward becoming a UDHP:

“Software Thinking” vs. “Platform Thinking.” To truly understand the transformative potential of Unified Digital Health Platforms, it’s crucial to distinguish between traditional “software thinking” and more expansive “platform thinking.” By their very definition, UDHPs aren’t simply new software; they represent a fundamental shift towards a platform business model, complete with a new set of rules requiring a different mindset for success.

Seth Joseph astutely observed that EHRs still think of themselves as software companies, whereas the bigger opportunity is to migrate from being “a software vendor in the marketplace to the marketplace itself.” This transition necessitates a fundamental change in how these systems are conceived, built, and operated.

Expansion Through In-House Development vs. Expansion Through M&A. Historically, Epic has largely favored expansion through in-house development rather than embracing the platform strategy of growth through acquisitions and fostering an external ecosystem. Judy Faulkner, the influential founder of Epic, has famously stated Epic will never be sold and has also historically maintained a stance against acquiring other companies.

This inward focus contrasts sharply with the approach of established platform giants who have made hundreds of acquisitions:

Alphabet (Google) — 200+

Amazon — 125+

Meta — 100+

Microsoft — 275+

To scale effectively and exponentially, it’s necessary to take an ecosystem-first approach.

Foot-Dragging On Interoperability vs. Interoperability by Default. The early historical approach of many EHR vendors has been characterized as foot-dragging on interoperability, a stark contrast to the “interoperability by default” ethos of successful platform businesses.

Building One Company vs. Building an Ecosystem of Partners. Finally, until the past decade the traditional EHR model was operated under the assumption that external developers weren’t truly necessary, a viewpoint diametrically opposed to the platform business model where developers are central.

In 2017, Epic opened its app store to a slow start. Epic was viewed as unresponsive by many app developers. We also remember developers claiming that Epic was not respecting their intellectual property rights, i.e., “Your IP is now our IP.”

Epic has since developed much more vibrant developer programs. In yet another blog post, Brendan Keeler describes and rates developers’ options in working with Epic. He concludes by advising devs to “temper your expectations.”

Synthesis and Conclusion:

OK, we’ll admit that the Thesis/Antithesis thing was a little dramatic. Let’s revisit the wording:

- Thesis: EHRs Can Expand To Becoming UDHPs

- Antithesis: EHRs Can’t Become Effective UDHPs

We’ll also concede that the wording is a bit misleading — it implies black/white scenarios under which EHRs either will or will not become UDHPs. The reality, as always, is messier than a binary choice. It’s not ‘EHRs will totally become UDHPs’ or ‘EHRs are doomed to the dustbin of history.’ It’s more like…shades of gray, with a healthy dose of ‘we’ll see.’”

The UDHP market is very early — the Gartner report that we cited in our previous blog post on UDHPs estimated that the market is only 5% penetrated and that UDHP adoption will take 5 to 10 years.

As we’ve noted, UDHPs can be adopted incrementally and over time. UDHPs can accommodate EHRs as components, and UDHPs and EHRs are not mutually exclusive: we don’t see EHRs as going away any time soon.

We expect that different organizations will make different decisions, depending on a number of factors such as:

- Size and resources. Larger health systems likely will see greater needs for a UDHP; smaller systems more likely will look to their EHR for integrations.

- Organizational complexity and geographic footprint. Multi-state footprints, a mix of care settings across the acuity spectrum, and wide ranges of specialties all add complexity, required connections, and more opportunity with a UDHP approach.

- Current EHR vendor. Some EHR vendors might succeed at developing UDHP capabilities, others might not. TBD.

- Pricing of UDHPs vs. EHRs. TBD.

- Evolution of UDHP capabilities and market acceptance. TBD.

- UDHP vendor and market evolution. In our previous post, we highlighted over 20 UDHP vendor “candidates”, and later suggested that this number would shrink drastically.

In our next post in this series, we’ll segment the healthcare provider market to evaluate for whom (which hospitals and health systems) the EHR could serve as the UDHP and when it makes sense to choose a cloud-first solution.

Vince Kuraitis JD/MBA is an independent consultant with over 35 years’ experience across 150+ healthcare & tech companies. Neil Jennings is Vice President, Consulting at Untangle Health. Vince publishes The Healthcare Platform Blog, where this post first appeared. The authors want to thank several colleagues for their review and commentary on an earlier draft of this post: Michael Byczkowski, Global Head of Healthcare at SAP; Brendan Keeler, Interoperability Practice Lead at HTD Health; Sandra Raup, President at Datuit; and Chris Notaro, CEO of Untangle Health.

Publisher: Source link