If you develop small- to medium-size community solar projects, chances are you’ve struggled to find the right financing.

Maybe equity doesn’t meet all your needs. Or, you’re holding onto the project for the medium or long term, and you want to collect cash flow. In either case, debt is your best bet — but big banks decline deals they deem too small, and many community banks shy away from funding solar because they’re not familiar with the economics of the sector.

The solution could lie with funders that sit between those two poles: nonbank lenders such as impact investment funds and mission-focused banks like NYCEEC and Connecticut Green Bank. As someone who works in this niche, I’m here to tell you what appeals to us and how to determine whether we’re a fit for you.

Many lenders in this space are mission focused, meaning they are primarily interested in financing projects that expand access to solar in low- to moderate-income (LMI) communities or are focused on reducing a community’s carbon footprint. They want to know who is benefiting from the installation and how it will create meaningful impact.

Loan sizes typically vary from $500,000 to $3 million. Our funding sweet spot lies in the $1 million to $6 million range, and we are most attracted to deals that offer opportunities for ongoing collaboration. That is especially important if you’re developing smaller projects. It makes more sense for us to expend the time and resources required to underwrite, approve and document each deal we commit to if we can build a fruitful long-term relationship with the developer. It helps if your project is in a state that has invested in creating markets for solar development — California, Colorado, Massachusetts and New Jersey are a few examples.

To boost your chances of success, keep your capital structure as simple as possible and ensure that your cash flow analysis makes sense. We prefer to be your only debt financier — and most others will too — but we’ll work with a tax equity investor or directly with the developer as the equity source. If you’re looking to bring in other investors or private grantors, that could complicate the structure. We also focus on projects with cash flow projections that demonstrate the ability to service the proposed debt with a reasonable cushion.

In addition, it’s essential to have your offtaker or power purchaser nailed down. Keep in mind that your offtaker’s strength can be a factor in securing financing: It’s easier to underwrite a deal if your purchaser is a large, established corporation than if it is a new or small organization. If you have a community solar project, lenders will want to know you’ve hired an experienced administrator who can handle the added complexity.

Overall, you should also be able to demonstrate that you’re knowledgeable, organized and trustworthy by identifying and explaining each of your project’s components. Your project should be fully permitted and financially viable; your partner relationships should be strong and clearly defined; and your project plan should accurately account for as many costs as possible.

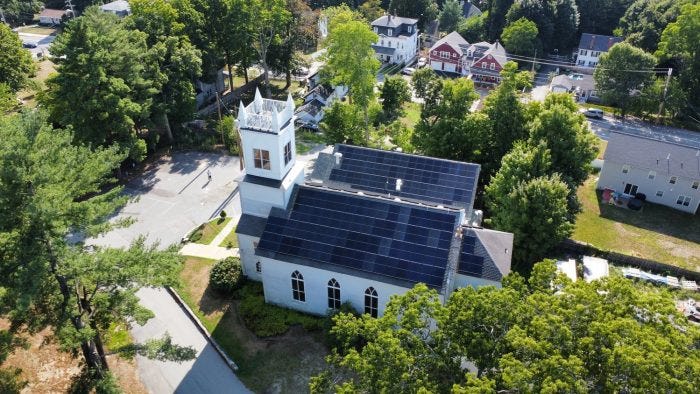

Sunwealth installation at Edwards Church in Framingham, Mass.

Our recent funding for Massachusetts-based Sunwealth is a best-case example of the type of deal we’re looking for. Our $5 million loan supports a portfolio of 26 community-based solar projects servicing nonprofits, houses of worship and other community institutions across five states. And more than one-third of the portfolio directly benefits LMI communities.

The financing structure allowed us to design debt funding to be efficient for us and manageable for them while enhancing our impact. If we’d approached each installation individually, the volume of work required to fund them would not have made sense for us. Pooling the assets allowed us to turn many tiny deals into one larger opportunity. Sunwealth’s market position and expansive portfolio also provides us potential for future collaboration.

Two individual projects we are in the process of funding — one in Maryland and one in New Jersey, both states that have created favorable markets for solar development — checked many of the same boxes as the Sunwealth deal. Although one loan was just under $1 million, the developers have a pipeline of projects that could lead to a lasting relationship, and that sweetened the deal.

Even if your project doesn’t hit all the marks initially, that doesn’t mean we can’t talk. If you’re still finalizing your site lease, for example, we can begin exploring a deal. One of the benefits of working with impact-focused midsize funders is that many of us offer more-specialized attention, and even if you’re not yet right for our portfolio, we may be able to provide advice on topics like how to win grants from public agencies. We want you to succeed.

Mission alignment also allows us flexibility on factors like project size, location and communication with your other partners. As two of the examples above illustrate, we can take on smaller projects if we see an opportunity for long-term collaboration. We’ll also explore funding developments in regions like the Southeast, where states have not created a favorable market for solar development, but myriad LMI communities could benefit from access to affordable renewable electricity.

And while we prefer not to play a funding coordinator role, we may be able to match you with potential funders in our impact investor network, and we’re happy to collaborate with the teams providing other forms of capital for your project.

The bottom line: If you’re building small- to mid-size community solar projects, there are debt funders that want to support you. Position yourself for success by 1) providing opportunities for long-term partnerships; 2) accounting for your funding sources, economics and project fundamentals; and 3) showing your impact.

This post originally appeared online in Solar Builder Magazine.

Publisher: Source link